The DKB bank account is one of the best free online bank account in Germany. Using it now for 9 years, I wrote this review: How to open the account, how the DKB Visa card works, and where you can withdraw money for free. (Spoiler: everywhere!)

Language support

Before you continue reading, here comes the first important issue: The DKB account has no English support yet. Neither their phone support nor their website or app speak English. If you don’t speak German at all, then better head right away to the free N26 bank account.

Additionally, there are even more free german bank accounts around, see my overview of them here.

This might change in the future, and recently I met a DKB official who told me that they’re working on their English support and it shall be there “soon”.

And until then, there is another trick: DKB has a lot of tutorial videos on their Youtube channel, all of them are subtitled in German. With Youtube’s auto-translate, you can change the subtitle language to any other one you speak.

Account types

To the rest of you (somewhat) German speakers, DKB offers three types of accounts, depending on the behaviour and background of the customer – all of them with a German IBAN number:

- Active customers are all new customers 12 months after account opening. To remain an active customer after that time, your accounts needs to receive incoming payments of at least 700 EUR per month. (This can be anything: salary, scholarships, payments from your parents etc.)

You can also spend this money immediately – what is only relevant: The sum of all incoming payments per month must be 700 EUR. - Standard customers: These are simply all customers who do not fulfill the conditions of active customers

- Students: You must be enrolled in a university or Fachhochschule – be it in Germany or abroad

The student account works then mostly like an active account:

| Feature | Active customer | Standard customer | Student account |

|---|---|---|---|

| Visa credit card | free | free | free |

| Girocard | free | free | free |

| cash withdrawal | free | EUR: free non-EUR: 1.75% | free |

| contactless payments | free | free | free |

| other payments | free | EUR: free non-EUR: 1.75% | free |

| ISIC student card for 1 year | – | – | free |

Cards

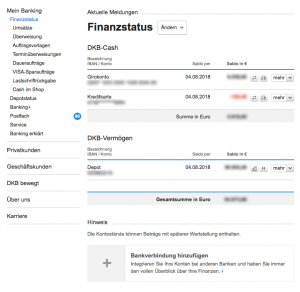

You will receive two free cards: A Visa and a Girocard. And both do actually run on two different accounts: The Giro account and the Visa credit card account:

- The money you transfer to your IBAN number will arrive on the Giro account.

- Spendings with your Visa card will be deducted from the credit card account.

Once a month, the minus on your credit card account will be refilled with a transfer from the Giro account.

So contrary to other offers like N26, the DKB Visa card is actually a credit card, meaning that you get some credit to spend in advance until you will be billed once a month.

The credit limit depends on how “trustworthy” you are, at the beginning it’s usually 500 EUR per month.

The limit is also the maximum you can spend with your Visa. Especially for bigger purchases like some airplane tickets, this can be too low.

But don’t worry, you can simply top up your Visa credit card account anytime you want. For instance, to buy something for 700 EUR, you can wire 200 EUR to the credit card account before.

Note also that cash withdrawals are taken from the Visa account, so be sure there is always enough on it, otherwise you won’t be able to get cash. Simply top it up if it’s running low, you can also setup a standing order (monthly automatically repeating transfer) if you need more than the credit card limit in cash per month.

Cash withdrawals

ATMs

This is the feature DKB is standing out for: Cash withdrawals are always free in the Euro area, for active customers even world-wide. No fee is applied, no matter how often you withdraw.

However, the minimum amount to withdraw is 50 EUR. No smaller withdrawals are possible.

For standard (non-active) customers, withdrawing outside Eurozone, a fee of 1.75% is applied.

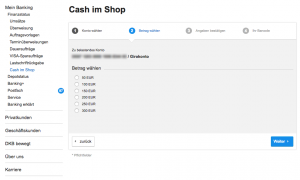

Cash im Shop

Besides ATMs, you can also “withdraw” money in shops: On the DKB website or within the mobile phone app, you can generate a barcode and then show it to the clerk in one of these shops:

- real

- Rewe

- Penny

- Mobilcom-Debitel shops

- Budni

- Ludwig, Eckert, Barbarino, Adam’s and ON!Express (mostly at train stations)

They will then scan the barcode, pay you out the sum and it will be deducted from your account.

(Contactless) payments

Both with the Visa card and the Girocard you can also pay directly in many shops, with Visa even contactless: Just hold your card close to the reader and amounts below 25 EUR will be deducted even without having to enter you 4-digit PIN number.

However, unlike at the N26 account there are no immediate push notifications when spending.

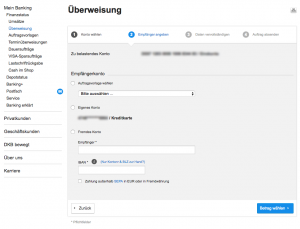

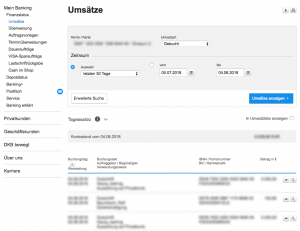

Online Banking: Screenshots

The website’s online banking is a pleasure for minimalists: Low on graphics, all mostly black and white (and some blue).

Mobile phone app

There’s a mobile phone app for Android and iOS, however it’s mostly just a wrapper around the website. Some features of the app:

- Login per fingerprint

- make a new transfer from a photo of a document: It will scan the document for any payment details like an IBAN number and then automatically open the transfer dialog with that data prefilled

- Verified by Visa protection: You can set the account to let you verify any online credit card payment in the app before making it, thus adding some security.

My review

DKB Cash was my first online bank account I opened, and I still use it today as my main account. I like it because:

- Cash withdrawals are super-easy: I simply can go to any ATM / bank machine anywhere and as much as I want and don’t have to worry about fees.

- I’m also using their free broker account* and it’s convenient to have both connected.

- The customer support is solid: I can call them 24/7 on a normal German landline number. They always were pretty competent and I got all my questions answered.

- The bank seems solid: I’m not aware of any bigger screw-ups, be it to myself or to others.

However, DKB is not my only account as I’m using N26 as a secondary account because there I get features that DKB is missing:

- Immediate push notifications when doing a payment (perfect for travelling).

- No withdrawal minimum amount.

- Partial card blocking (read more).

So N26 simply complements the missing features of DKB and therefore, as an ideal solution, I recommend using both in parallel.

Account opening

DKB is an online bank, so to open an account you don’t go to a branch but just click trough an online form:

After having filled out the form, they still need to verify your identity. To do that, there are two options: Post-Ident and Video-Ident.

Video-Ident

Video-Ident is the recommended way as it is the easiest and fastest. You need to have a computer, tablet or smartphone with a webcam.

Simply prepare your ID or passport. Then, follow the link to Video-Ident and you will soon be connected to a clerk via your webcam who will lead you through the process.

Post-Ident

The alternative to Video-Ident is Post-Ident. Here, you print out the relevant documents for Post-Ident a go with your ID or passport to the next Deutsche Post office.

If you have still questions about the process or the account, feel free to ask in the comments!

Links marked with a star (*) are affiliate links. If you click on such a link and then shop or order something, we will receive a commission for your purchase with which we can cover our expenses and keep the site free of ads. This does not change the price for you.